Why You Need To Take Into Consideration an Offshore Depend On for Safeguarding Your Properties and Future Generations

If you're aiming to secure your wealth and assure it lasts for future generations, taking into consideration an offshore trust could be a wise move. These trust funds use distinct advantages, such as improved asset defense and tax performance, while also keeping your personal privacy. As you explore the capacity of offshore depends on, you'll discover just how they can be tailored to fit your details requirements and objectives. However what exactly makes them so appealing?

Comprehending Offshore Trust Funds: What They Are and How They Function

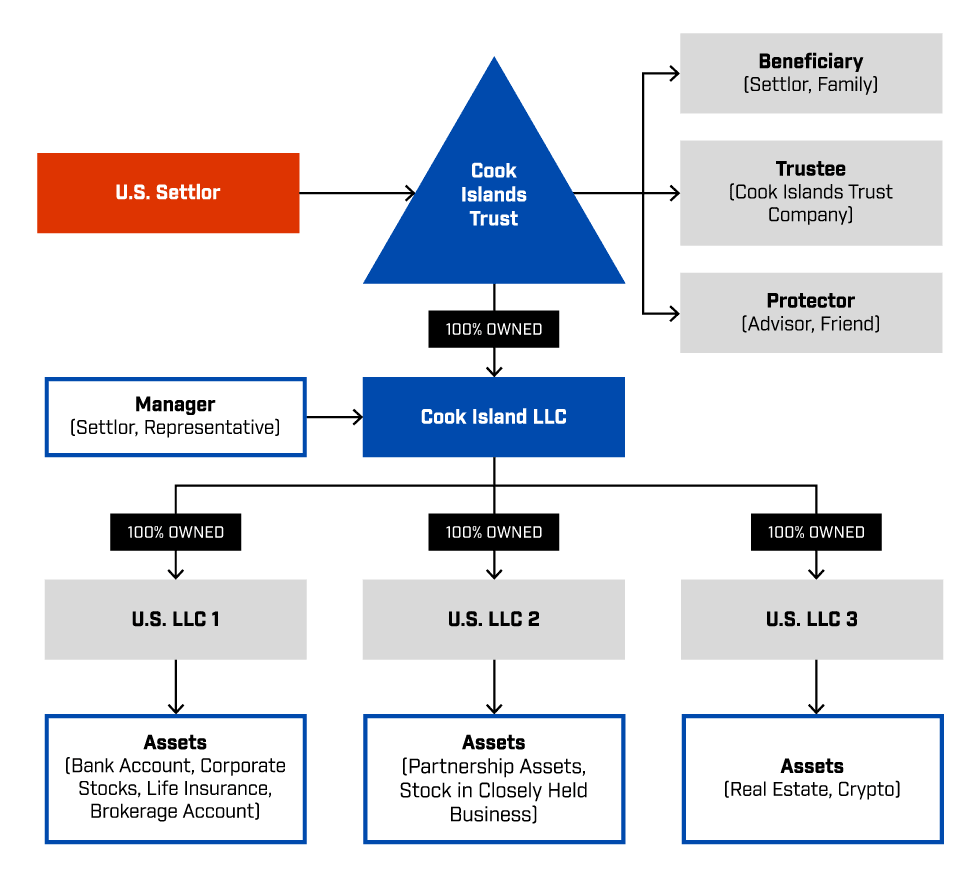

When you think of securing your properties, offshore trusts might come to mind as a sensible alternative. An offshore trust is a legal arrangement where you transfer your possessions to a trustee located in one more country. This trustee handles those possessions on part of the recipients you designate. You maintain some control over the trust, however the legal ownership shifts to the trustee, using security from potential lenders and legal cases.

The trick parts of an overseas depend on include the settlor (you), the trustee, and the beneficiaries. You can customize the depend your needs, specifying exactly how and when the possessions are dispersed. Given that these trusts frequently run under favorable laws in their territories, they can give enhanced privacy and protection for your wealth. Comprehending exactly how overseas counts on feature is important prior to you choose whether they're the best selection for your possession security technique.

Advantages of Establishing an Offshore Depend On

Why should you take into consideration establishing an offshore count on? In addition, offshore depends on offer versatility regarding possession administration (Offshore Trusts).

Offshore trust funds can give a greater level of privacy, shielding your financial events from public examination. Developing an offshore trust can promote generational wide range conservation. Eventually, an offshore trust fund can offer as a tactical tool for safeguarding your monetary tradition.

Securing Your Possessions From Legal Cases and Financial Institutions

Establishing an offshore trust fund not only offers tax obligation advantages and personal privacy however also functions as an effective shield versus lawful insurance claims and lenders. When you place your assets in an overseas depend on, they're no longer considered part of your individual estate, making it a lot harder for lenders to access them. This separation can safeguard your riches from lawsuits and claims emerging from organization disagreements or individual liabilities.

With the right jurisdiction, your assets can benefit from stringent privacy regulations that hinder lenders from pursuing your riches. Furthermore, many overseas trust funds are created to be challenging to penetrate, often calling for court action in the count on's territory, which can serve as a deterrent.

Tax Effectiveness: Reducing Tax Responsibilities With Offshore Depends On

Furthermore, considering that counts on are often tired in a different way than individuals, you can benefit from lower tax prices. It's vital, nevertheless, to structure your trust appropriately to ensure compliance with both residential and worldwide tax obligation legislations. Collaborating with a competent tax advisor can aid you browse these complexities.

Guaranteeing Personal Privacy and Discretion for Your Wealth

When it involves safeguarding your wide range, guaranteeing personal privacy and privacy is essential in today's increasingly transparent economic landscape. An offshore trust fund can supply a layer of protection that's difficult to achieve via domestic alternatives. By placing your possessions in an offshore territory, you shield your monetary details from public scrutiny and minimize the risk of undesirable focus.

These counts on frequently include rigorous privacy legislations that avoid unapproved accessibility to your monetary details. This implies you can secure your riches while keeping your comfort. You'll also limit the opportunity of lawful conflicts, as the information of your trust continue to be private.

In addition, having an offshore depend on implies your assets are much less at risk to personal obligation cases or unanticipated economic go to this site situations. It's an aggressive step you can take to assure your monetary tradition continues to be undamaged and exclusive for future generations. Count on an overseas framework to secure your wealth effectively.

Control Over Asset Distribution and Management

Control over asset distribution and management is just one of the vital benefits of establishing an overseas depend on. By developing this trust fund, you can dictate exactly how and when your properties are distributed to recipients. You're not just turning over your wide range; you're establishing terms that reflect your vision for your legacy.

You can establish certain problems for circulations, assuring that recipients fulfill particular standards prior to receiving their share. This control aids prevent mismanagement and guarantees your assets are used in ways you deem appropriate.

Furthermore, designating a trustee enables you to hand over administration duties while preserving oversight. You can pick a person that straightens with your values and understands your objectives, assuring your assets are managed carefully.

With an overseas trust fund, you're not just guarding your wealth but likewise shaping the future of your beneficiaries, providing them with the support they need while keeping your wanted degree of control.

Picking the Right Territory for Your Offshore Depend On

Look for countries with solid legal structures that sustain count on regulations, making sure that your assets stay protected from potential future insurance claims. Additionally, availability to local banks and knowledgeable trustees can make a big distinction in managing your count on effectively.

It's vital to assess the expenses included as well; some jurisdictions may have higher configuration or upkeep costs. Inevitably, choosing the best jurisdiction implies aligning your monetary objectives and family members requires with the details benefits supplied by that location - Offshore Trusts. Take your time to research and seek advice from professionals to make the most educated choice

Often Asked Inquiries

What Are the Prices Associated With Setting up an Offshore Count On?

Establishing an overseas trust fund involves different prices, consisting of legal charges, arrangement fees, and continuous upkeep costs. You'll intend to spending plan for these aspects to ensure your depend on runs effectively and properly.

Just How Can I Discover a Reputable Offshore Trust copyright?

To locate a reputable overseas trust service provider, research online reviews, request for references, and validate qualifications. Ensure they're skilled and transparent concerning costs, solutions, and laws. Trust fund your impulses throughout the option procedure.

Can I Handle My Offshore Count On From Another Location?

Yes, you can handle your overseas trust fund remotely. Several suppliers use on the internet access, permitting you to keep track of investments, interact with trustees, and access records from anywhere. Just assure you have protected internet access to protect your details.

What Occurs if I Transfer To a Various Country?

If you transfer to a various nation, your overseas depend on's policies might transform. You'll need to speak with your trustee my link and possibly change your trust fund's terms to abide with neighborhood legislations and tax obligation implications.

Are Offshore Trusts Legal for Citizens of All Nations?

Yes, offshore depends on are lawful for citizens of lots of nations, yet policies differ. It's important to investigate your country's laws and get in touch with a legal professional to assure conformity and understand possible tax implications before continuing.